The 6 Rules

Simple enough? The rules are so straightforward that they fit on a napkin. But don’t be fooled, they capture a lot of insight. More importantly, they’re the starting point on the path to financial freedom. You might want to create your own napkin, or at least a good substitute, so that you never forget the rules.

And now that you know “the rules,” the next steps on your “to do” list should be to: (1) learn the background knowledge relevant to each rule, (2) understand the challenge associated with each rule, and (3) create the plan that will help you follow each rule.

We’re making videos to provide guidance. See the Videos page for what we’ve posted so far, and don’t forget to check back regularly. We’ll be posting new videos all the time. For now, let’s take a minute to think about how the rules fit together to create a complete financial plan:

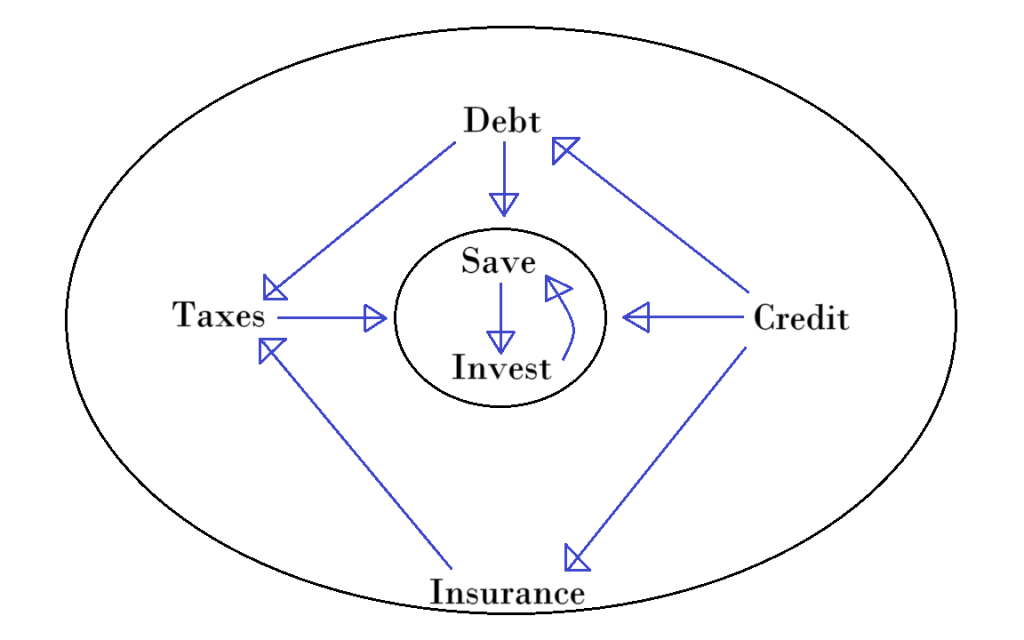

Start at the center. Saving and investing are at the core of the plan because they’re where financial success begins. You have to find a way to save some money, some way, somehow, possibly with the help of budgeting, and/or finding ways to make more money.

Saving provides you with money for investing, which you must do if you’re going to build your net worth by significant amounts. Some investments generate regular cash flow, which is good for your budget, and helps you save and invest more. It’s a marvelous cycle to have working in your favor.

Now let’s move outside of the core, beginning with taxes. By being strategic about reducing your taxable income, you can reduce and/or defer the taxes that you pay, making it possible for you to again save and invest more.

Next is debt. “Good” debt, like loans for education that improves your earning power and mortgages on investment properties, increases your income so that you can save and invest more. “Bad” debt, such as credit card balances and personal loans, costs you money that could otherwise be used for saving and investing. This reduces your ability to build wealth. Debt can also affect your taxes (for the better!) because the interest on certain kinds of debt is tax deductible.

Good credit allows you to obtain debt under better terms, such as at lower interest rates and with smaller down payments. This reduces the cost of your borrowing, so you can… can you guess? Save and invest more! Are you starting to get the hang of this?

And there are additional benefits to having strong credit. First, it can save you money directly because rental property owners give preferential treatment to tenants with great credit. Utility companies usually don’t require deposits from people with great credit. And strong credit can save you money on insurance because insurance prices are sometimes based partly on credit.

Finally, insurance (examples: home, auto, liability, health, disability, and life) is the barrier that protects your financial universe from things that could go wrong, like an accident or serious illness. It’s an essential part of any good financial plan. And if you pay health, dental, vision, and/or life insurance premiums through payroll deductions from your pre-tax income, you can reduce your taxable income and the income tax that you pay!

Was that a lot? If “No,” apologies for leaving you unsatisfied. We’ll try to make it up to you. If “Yes,” well, that’s why we’re making videos. So, don’t forget to check the Videos tab to learn more about all of the above!